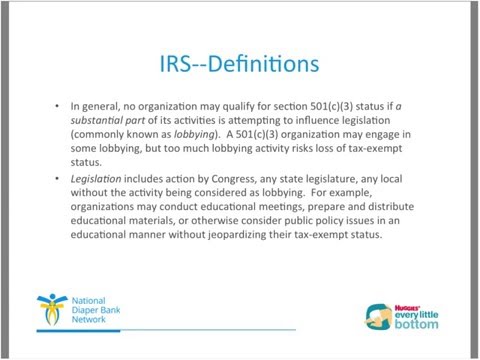

Divide this text into sentences and correct mistakes: 1. So what is lobbying and what is advocacy? Advocacy is educating and raising awareness of the issues. It is our first mission as a 501(c)(3) to raise awareness of segregated homes across the country. So, talking about diaper needs is advocating on behalf of the folks who need diapers. It's raising awareness that this is an issue for people out there. Advocacy does not endorse or oppose specific legislation. 2. If you talk to your legislators about the work of your diaper bank and there is a diaper bank that's advocating, and you're asking your legislators to put money into the state budget for your diaper bank, that is lobbying. It's sort of the basic, quick and dirty advocacy. There are no limits. You, as a 501(c)(3), are expected to advocate on behalf of your programs, to talk about what you're doing, to raise awareness, and educate folks about what it is you're doing and why it's important. 3. Lobbying is also allowed. There are some more limits on it, but it is perfectly within your rights as a 501(c)(3) to talk to your legislator and lobby on behalf of programs and legislation before the Congress or the State House of states or Senate that will benefit your diaper bank and benefit the folks you serve. 4. Partisan political activity, however, is never allowed. So, you can't physically endorse a candidate. You can't even specifically endorse a party per se. But what you can do is talk about legislation, actual issues or actual bills before Congress. But you can't talk about candidates. There's some gray areas on that, but all but as far as you can't specifically endorse a person but you can specifically endorse a piece of legislation. And if you have any questions,...

Award-winning PDF software

The 501(h) election requires organizations to Form: What You Should Know

Lobbying 101 Nonprofit Lobbying The Internal Revenue Code defines “lobbying” as “political activity on behalf of (1) non-profit organizations if (2) the organization has an annual budget or other resources of more than 100,000, if (3) the organization was created on a 'progressive' philosophy, or if (4) its activities are directed at advancing its political or ideological objectives that favor (1) social or economic welfare, (2) government reform, (3) the abolition of poverty, (4) the protection of human rights, or (5) the equal enjoyment of rights.” In some cases, a 501(c)(3) organization has a lobbying activity only if the organization does more than just lobby. The 501(c)(3) must report the sum of expenditures and lobbying income in excess of its lobbying activity limits: Lobbying 101 — Blogger's Guide Tax Forms Form 990's Schedule C has a requirement to file the Form 990 document in the same form the organization submits to the IRS. IRS 501(c)(3) Requirements The IRS defines “501(c)(3)” organizations as “private non-profit corporations organized and operated exclusively for exempt purposes.” Under current IRS guidelines, a 501(c)(3) organization may be organized and operated with an unlimited budget with only modest lobbying. According to IRS' guidance on the status and contribution limits of nonprofit corporations organized by 501(c)(3) organizations: In general, the contribution-to-expenditure ratio (CCR) of a 501(c)(3) organization is limited to 1:100. A non-exempt contribution to a 501(c)(3) organization can be made to any of the corporation's authorized functions. In general, the assets held by a 501(c)(3) organization are not deductible against its tax liability as a deduction for contributions. However, donations to a 501(c)(3) organization are allowed deduction against its liability to the IRS if the aggregate amount of contributions to the same organization, made directly to each member of the organization by one individual and accepted from that individual, exceeds 5% of the total assets of the organization at all times before such contribution is made. In general, 501(c)(3) organizations are limited to contributing no more than 50% of any amount contributed to its authorized functions.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5768, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5768 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5768 By using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5768 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing The 501(h) election requires organizations to