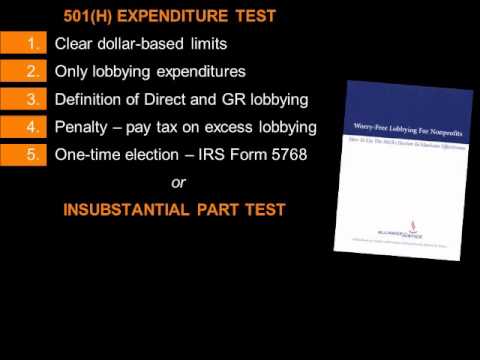

In this presentation, I'll be talking about how much lobbying a 501(c)(3) organization can do. You probably already know that 501(c)(3) public charities can lobby under federal tax law, which sets out the rules for tax-exempt organizations like 501(c)(3)s. It tells us that 501(c)(3) public charities can lobby within certain annual limits. The question for c3 is then, what are those limits? 501(c)(3) public charities, which is what many nonprofits are, have the option to calculate their lobbying using one of two choices: the 501(h) expenditure test or the insubstantial part test. A 501(c)(3) charity will be under one or the other, never both. For almost all c3 charities, we think that the 501(h) expenditure test is the better option for a number of reasons. I'm going to lay out those reasons and then talk about the alternative way for a 501(c)(3) charity to measure its lobbying, the insubstantial part test. The publication you see on the right of the screen called "Worry-Free Lobbying for Nonprofits" is available for free on our website, and it lays out these reasons in greater detail. I'm going to start out by talking about the 501(h) expenditure test since, as I just mentioned, this is the option we recommend for most 501(c)(3) public charities. That number, 501(h), comes right out of the federal tax code, and a 501(c)(3) organization choosing the 501(h) expenditure test remains a 501(c)(3) organization, just one that determines its lobbying limit under that 501(h) expenditure test. Under the 501(h) expenditure test, a 501(c)(3) charity gets clear dollar-based limits to determine how much they can lobby. Those limits are calculated based on a simple formula. The next important point about the 501(h) expenditure test is that only what the c3 actually spends on lobbying counts toward the organization's annual lobbying limit. That means that low-cost...

Award-winning PDF software

Insubstantial part test Form: What You Should Know

Lobbying Rules for 501(c)(3) Public Charities — Holland (The IRS has a handy chart about the rule here.) When a tax-exempt nonprofit must register as a lobbyist: It must have the following three elements in place: (1) a clearly marked and prominent notice on the IRS website that the organization is now required to register as a lobbyist; (2) registration in the state in which it conducts activity, including, for corporations, the names, address, and registration number of all officers of the organization, including management; and (3) a description of the activities conducted by the organization that may involve lobbying. Organizations also must be subject to audit. [1] Lobbyist rules for public charities: A public charity that maintains its 501(c)(3) tax status must comply with the provisions of these rules and other pertinent federal, state, and international law. The tax status of a public charity in the event of a finding that it has become a lobbying organization is subject to revocation of the charitable tax receipt. Furthermore, a public charity must notify the IRS and the Department of Justice of any material change in its legal status. Additionally, a public charity may be subject to criminal penalties if it fails to notify the IRS or Congress of a change in status. For more information, go to these pages: and For more about the law and regulations about lobbying go here It is a public charity's responsibility to ensure that all registered lobbyists work only for the client that hires them. You can review your client's lobbying contract here and see a complete list of lobbyists. Lobbying is legal under certain circumstances. The IRS has published a list of lobbying entities, you can find it here.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5768, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5768 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5768 By using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5768 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Insubstantial part test