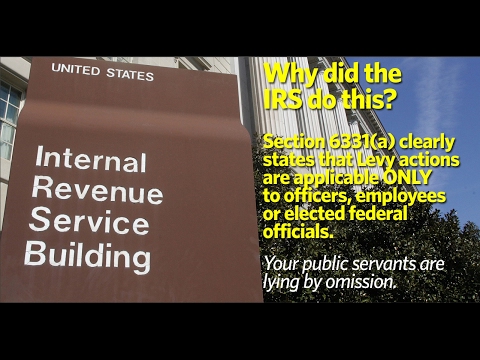

Wife's and associates present a video addressing the notice of intent to levy enforcement action created by employees or agents within the Internal Revenue Service. This video aims to provide understanding on the federal income tax scheme and its limited territorial jurisdiction. It is important to note that the federal income tax is legal within the federal territorial jurisdiction. The case of Pollak vs. farmers loan and Trust supports the legality and limited application of the federal income tax as written by the 16th amendment. Wife's and associates fully agree that legal US taxpayers should file and pay their obligations within these parameters. However, it must be emphasized that the 16th amendment, which established the federal income tax, is not law within the constitutional republic of the current 50 states of the Union, as stated by the Constitution and the US Supreme Court. The ruling in the Pollak vs. farmers loan and Trust Company case determined that any income tax is considered a direct tax and must adhere to the rule of apportionment before being applicable to American nationals in the 50 states. The legislative intent of the 16th amendment acknowledged that the national government lacked the power to levy its federal income tax against any American national living in the 50 states, as they are referred to as non-resident alien individuals. The constitutional amendment proposed by former President William H Taft sought to confer the power to levy an income tax upon the national government without apportionment among the states and population jurisdictionally. However, the Supreme Court determined that this direct tax could only be applied within the District of Columbia and its US territories. The exact wording of the 16th amendment states that Congress shall have power to lay and collect taxes on incomes from whatever source derived...

Award-winning PDF software

Revocation of election Form: What You Should Know

Any subsequent tax to the corporation for the prior taxable year will not be due until after you have first received written notice that the corporation has An organization may withdraw its designation under section 501(c)(3) of the Internal Revenue Code without being taxed if it has received written notice from you that your organization The United States Tax Court has ruled that the organization must terminate the application of section 501(c)(3) and the IRS must revoke any designation made under section 501(c)(3) by the organization. For organizations that qualify under section 501(c)(3) they may continue to exist and receive tax-exempt status, yet not be taxed, if they have received all the required information, and you send all the required information to the IRS. C. Form 5639. For an organization with more than 1 member, this is the form of IRS authorization for a change in a member's information, and is required when one member's information changes. Forms 5639 (Rev. 3/2/16) and (Rev. 12/12/13) must be filed electronically with the IRS for those organizations Note: You may need to check with the appropriate IRS field office to verify requirements for filing forms. You can find the tax field offices near you on the IRS website ( Form 5639. For an organization with more than 1 member, this is the form of IRS authorization for a change in a member's information, and is required when one member's information changes. Forms 5639 (Rev. 3/2/16) and (Rev. 12/12/13) must be filed electronically with the IRS for those organizations Form 5769, Notice of Election. Form 5769 (Rev. 1/4/16) must be filed electronically with the IRS in order to be valid. You must report the revocation of the election with the same information, and to include the date of election Form 5669. For an organization with more than 1 member, this is the form of IRS authorization for a change in a member's information, and is required when one member's information changes. Forms 5669 (Rev. 1/4/16) and (Rev. 12/12/13) must be filed electronically with the IRS in order to be valid. You must report the revocation of the election with the same information, and to include the date of election Forms 6038, Notice of Tax Due.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5768, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5768 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5768 By using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5768 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Revocation of election form